18 minutes read

18 minutes read

Look, if you're trying to figure out how to reduce operational costs, you need to stop staring at the expense report and start looking at the real problems. Real cost-cutting isn’t about buying cheaper coffee. It’s about digging into the silent cash drains hiding in your day-to-day operations, your bloated tech stack, and your outdated team structure.

Let's be real. Most advice on this topic is a snoozefest of useless tips. "Cancel unused subscriptions." Groundbreaking, right? If it were that simple, you wouldn't be here. The costs that truly cripple a business aren’t the obvious line items; they’re buried in how your company actually runs.

I learned this lesson the hard way. My first business nearly went under because I was too busy frantically cutting small, visible costs. I was metaphorically mortgaging the office ping-pong table while five-figure invoices from inefficient processes were bleeding us dry. Classic case of treating the symptoms, not the disease.

The first step is a serious reality check. You have to hunt down the expenses that look good on paper but deliver zero actual return. I call these "vanity expenses." That fancy downtown office lease might impress a few clients, but if your team is just as productive working remotely, it's a seven-figure paperweight.

It’s also crucial to give your tech stack a hard look. That shiny new software platform you were sold might be costing you far more than just the license fee. Think about these hidden drains:

The most dangerous costs are the ones that disguise themselves as investments. Before you can optimize, you have to diagnose. What's actually moving the needle, and what’s just expensive window dressing?

Moving from short-term panic to strategic cost management is the only way to survive. This means looking at your core functions and asking some tough questions. For instance, are you paying a full-time, in-house team for tasks that are cyclical or project-based? This is where many businesses, especially law firms, leak cash like a sieve.

A perfect example is when firms maintain large support staffs to handle fluctuating caseloads, leading to expensive downtime during slower periods. Instead of carrying that fixed payroll cost, a much smarter approach is to use on-demand help.

Exploring specialized legal outsourcing services can turn a fixed expense into a variable one. This allows you to scale your support up or down as needed without the overhead of permanent hires. This isn't just about cutting costs; it's about building a more agile, resilient operational model.

Let's talk about the big, expensive elephant in the room: your office lease. For years, the fiercest debate in law firm management was over open-office plans versus private offices. Now, the real question is whether you need that physical headquarters at all.

For many firms, that prestigious downtown address has become a multi-million dollar paperweight. It’s an expensive habit. That prime real estate isn't just about rent; it’s utilities, insurance, maintenance, and a dozen other line items that quietly bleed your budget dry.

When you look at the numbers, the case for remote and hybrid work isn't just compelling—it's a landslide victory for your bottom line.

This isn't about saving a few bucks on the electricity bill. Embracing a more flexible model is a fundamental shift in how your firm operates, hires, and scales.

Research shows that law firms and other professional service businesses can slash overhead by up to 30% by adopting a hybrid structure. For a typical firm, that can translate to saving around $10,000 per employee annually—a figure that’s impossible for any managing partner to ignore. You can find out more about these cost-reduction strategies and how they can reshape your budget.

But the real magic happens when you look beyond direct savings. Suddenly, you're not limited to hiring the best paralegal or associate within a 30-mile radius. You can hire the best person, period.

When you unchain your firm from a physical address, you’re not just cutting costs. You’re tapping into a global talent pool and building a more resilient, agile organization. It’s the ultimate operational advantage.

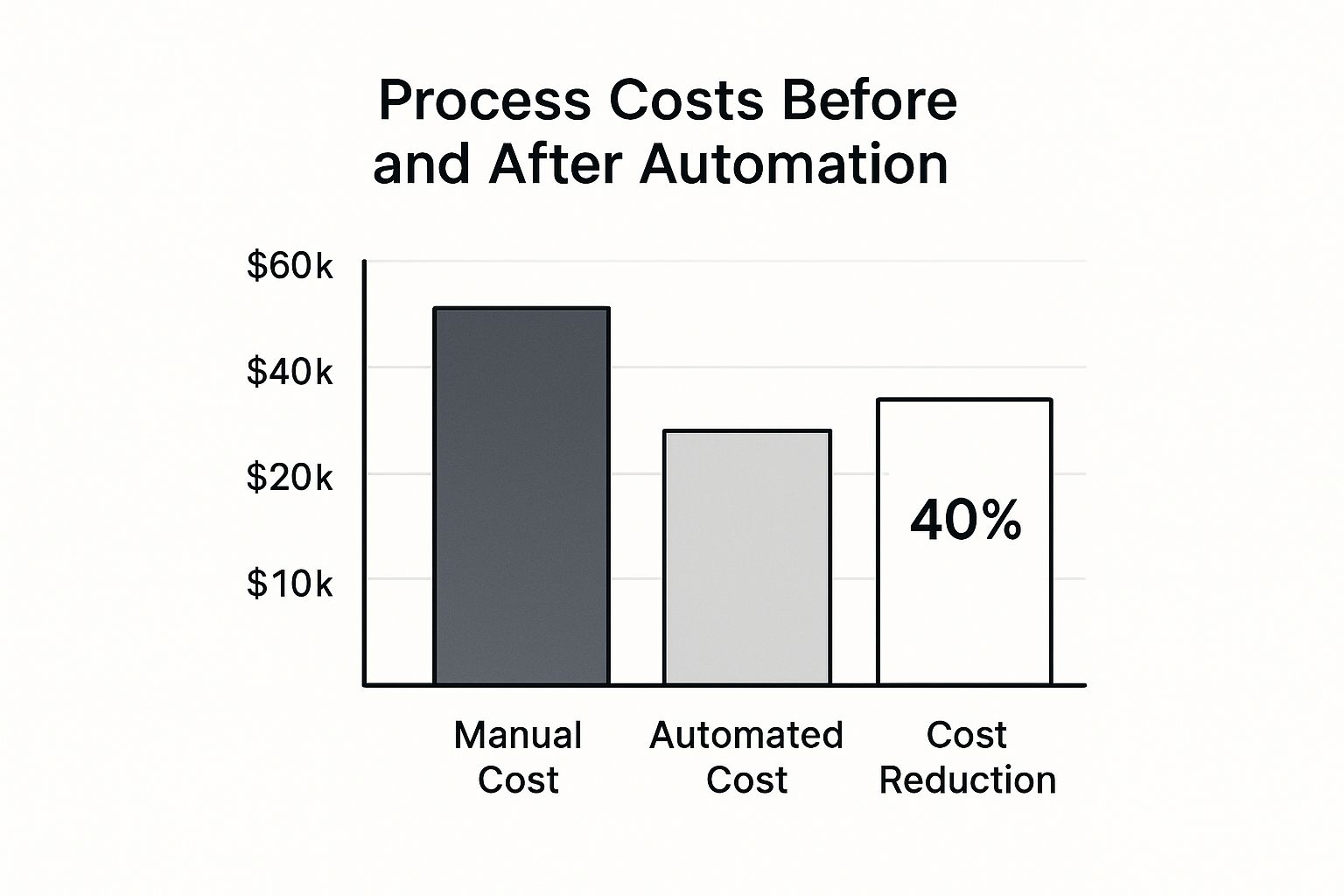

This visual drives the point home by comparing process costs. It highlights how a strategic shift—like moving away from manual, location-dependent tasks—can lead to massive savings.

A 40% cost reduction is absolutely achievable when you replace outdated, expensive processes with more efficient, location-independent ones.

Let's break down the numbers with a pragmatic comparison. The table below illustrates the potential annual savings per employee when moving from a fully traditional office to a hybrid model. The differences are staggering.

| Cost Category | Traditional Office (Annual Per Employee) | Hybrid Model (Annual Per Employee) | Potential Savings |

|---|---|---|---|

| Office Rent & Utilities | $12,000 | $6,000 (smaller space/hot-desking) | $6,000 |

| Office Supplies & Equipment | $2,000 | $1,000 (less daily use) | $1,000 |

| Daily Commuting & Parking | $3,000 (stipends/subsidies) | $1,500 (fewer days in office) | $1,500 |

| IT & Infrastructure | $2,500 (on-premise servers) | $1,800 (cloud-based) | $700 |

| Employee Perks (coffee, snacks) | $1,200 | $600 | $600 |

| Total Annual Cost | $20,700 | $10,900 | $9,800 |

As you can see, the savings aren't just marginal; they add up to nearly $10,000 per employee each year. For a firm with 20 employees, that’s almost $200,000 back into your operating budget annually.

Of course, going hybrid isn’t as simple as sending everyone a Zoom link and calling it a day. Managing a distributed team is a completely different beast. It demands a deliberate cultural shift and, more importantly, the right set of tools.

The key is to avoid over-investing in hyped-up "virtual office" platforms that nobody actually uses.

Instead, focus on the absolute non-negotiables:

Forget the fancy virtual watercoolers and digital happy hour apps for now. Nail these three core areas first. The rest is just noise. The goal is to build a system that empowers your team to do their best work, regardless of where they are. That’s how you truly reduce operational costs and build a law firm for the future.

Let's talk about procurement. If that word makes your eyes glaze over, I get it. But your procurement strategy—or, more likely, your lack of one—is quietly draining your bank account every single day.

Too many companies treat buying like a free-for-all, where every department head has a company card and a dream. That’s not a strategy; it’s an invitation for waste. Buying should be a strategic function, not an impulse decision made over a weak cup of coffee.

This is where we get into the weeds of category management. It sounds like jargon, but it just means not buying stuff like a rookie. It's about bundling your purchases, negotiating from a position of strength, and treating your suppliers like partners, not just vendors on an invoice.

The quickest win? Centralize your purchasing. When every team buys its own software, subscriptions, and supplies, you’re leaving an insane amount of money on the table. You lose all your bargaining power.

I saw this firsthand at a mid-sized firm. We ran an audit and discovered three separate practice groups were paying for nearly identical project management tools. The total cost was obscene. By consolidating everyone onto a single platform and negotiating a real enterprise deal, we slashed that specific SaaS bill by 40%. That’s not a rounding error; that’s a new hire.

This isn't just about software. It applies to everything:

When you negotiate as one firm instead of ten tiny departments, you fundamentally change the power dynamic. You stop being a small-time customer and start being a valuable client.

The impact of this shift is massive. Research shows that effective category management can deliver procurement cost savings of 10–15% annually.

By consolidating your spending and standardizing what you buy, you create economies of scale that let you negotiate much better terms. Some firms have cut spending on indirect categories by up to 20% just by getting organized. You can explore the full research on procurement cost reduction to see how deep these savings can go.

It’s a simple concept with profound results. Stop the rogue spending. Create a single, clear process for how your firm buys things and appoint someone to own it. This isn't about adding bureaucracy; it’s about plugging a hole in your budget that's been leaking cash for years. It’s how you transform procurement from a boring administrative task into a powerful engine for savings.

Let’s be honest. How many hours a week does your team burn on tasks a reasonably intelligent toaster could handle? I’m talking about manual data entry, pulling the same report every Friday, and sorting client emails. These are the soul-crushing, repetitive jobs that are perfect candidates for automation.

This isn’t about some sci-fi fantasy of replacing your team. It’s about freeing them up to focus on the high-value work that actually grows the firm. No one ever won a major case by being the best at copy-pasting data into a spreadsheet.

We're talking about practical, off-the-shelf tools that can automate workflows in finance, HR, and client support for a fraction of what it costs to hire another person.

Before you dive in and try to automate everything, you need a plan. If you don't, you’ll end up with a messy, expensive tangle of software that creates more problems than it solves. The goal is to pinpoint the tasks that are both mind-numbingly repetitive and have a high risk of human error.

From my experience, here’s where firms see the biggest, fastest wins:

The best processes to automate first are the ones that make your team say, "I can't believe we used to do this by hand." Find that pain point, and you've found your starting line.

Once you’ve nailed the basics, you can move on to more sophisticated automation that directly impacts your bottom line. This is where AI-driven tools and robotic process automation (RPA) come into play, handling complex back-office functions that traditionally required a ton of human oversight.

McKinsey’s latest research is eye-opening. It shows that companies using AI-driven automation have seen operational cost reductions of up to 30%. They’re using smart software to manage those repetitive back-office functions, which cuts labor expenses and costly mistakes. Even mid-sized businesses report annual savings in the hundreds of thousands, sometimes millions. For a deeper dive, you can dig into the full CIO playbook on cost efficiency.

Think about the real-world impact. A single data entry error in a legal filing can have catastrophic financial consequences. An automated system doesn’t get tired, distracted, or have a bad day. It just executes the process perfectly, every single time. This isn’t just about reducing operational costs; it's about building a more accurate and reliable firm from the ground up.

Now for a dose of reality. The temptation is to buy the fanciest, most expensive "all-in-one" automation platform on the market. Don’t do it. You'll end up paying for a hundred features you never use.

Start small. Pick one process that's a known bottleneck in your firm. Implement a targeted, affordable solution and actually measure the impact. Did it save time? Reduce errors? Improve client response times?

Once you’ve proven the ROI on that small experiment, you’ve earned the right to tackle the next one. This methodical approach ensures you’re making smart investments, not just buying more tech for the sake of it.

Alright, you’ve put in the work. You’ve automated processes, outsourced tasks, and renegotiated contracts until you're seeing them in your sleep. So, what now?

You can't just cross your fingers and hope it all pays off. Hope isn't a business strategy, especially when it comes to your bottom line.

Unless you track your results obsessively, you're flying completely blind. This is where most cost-cutting initiatives go to die—a slow, quiet death from a lack of follow-through. It’s time to build a simple, no-nonsense dashboard that tells you, in real-time, if your efforts are actually moving the needle.

Forget the vanity metrics that look impressive but mean nothing. We need to focus on the numbers that tell you if your firm is financially healthy or on life support.

Your gut instinct is great for making bold, strategic moves, but it’s a terrible tool for day-to-day financial management. We need to cut through the noise with Key Performance Indicators (KPIs) that matter.

Stop trying to track a million different things. Focus on the vital few that have a direct line to your firm's bank account.

These are the metrics I obsess over:

Your dashboard shouldn't be a data graveyard. It should be a living tool that sparks tough conversations and forces you to make decisions. If looking at it doesn't make you at least a little bit uncomfortable, it’s not doing its job.

Of course, trying to track all of this in a spreadsheet is a recipe for errors and wasted time. This is where a good system becomes non-negotiable.

The right software can pull this data automatically, saving you from the soul-crushing task of manual entry. Many firms are discovering that the best legal case management software often comes with powerful reporting tools that make building these dashboards surprisingly straightforward.

Data is useless without action and accountability. That’s why you need to implement a weekly cost review meeting. And no, this isn't just another pointless meeting to clog up everyone's calendar.

This is a 30-minute, standing-room-only (if you have to) session with one singular purpose: review the dashboard and assign action items.

The agenda is brutally simple:

That's it. Meeting over.

This relentless focus is how a cost-reduction plan becomes ingrained in your firm's culture. Because what gets measured gets managed. And what gets managed, ultimately, gets fixed.

Alright, let's get into the messy part. When law firm partners get serious about the bottom line, the same anxieties tend to surface. Forget the corporate jargon; here are some direct, no-fluff answers to the real-world concerns you’re probably wrestling with right now.

This is where the rubber meets the road. It’s one thing to make a plan, but it's another thing entirely to execute it without upsetting the entire firm.

This is the big one. Will cutting costs make my best people think the firm is sinking?

Not if you handle it like a leader, not an accountant. The key is transparency. Don't just announce that the budget for the annual retreat is gone. Frame it as a strategic shift: "We're reallocating funds from X to invest in Y, which will help us secure bigger clients and create more long-term opportunities for everyone."

Legal professionals are smart. They can tell the difference between panicked, slash-and-burn cuts and deliberate, strategic investments. Bring your team into the conversation. Your paralegals and legal assistants often know exactly where the inefficiencies are. Making them part of the solution is empowering, not demoralizing.

The narrative you create is everything. Are you a captain frantically bailing water from a leaky boat, or are you charting a smarter, more efficient course? Choose the latter.

The paralysis of choice is real. When every expense seems critical, it's tough to know where to begin. So, where do you aim your cost-cutting efforts first?

Start with the least emotional, highest-impact areas. For most firms, this means scrutinizing your biggest non-payroll expenses, like software subscriptions, premium office space, or vendor contracts. These line items are often bloated with legacy costs and redundancies.

One firm I know realized they were paying for a top-tier document management system with features they never used. They migrated to a more modern, scalable solution and cut their software spend in that one area by a staggering 60%. That’s a move that doesn’t impact a single employee’s daily work but adds significant capital back to the firm.

Can you go too far? Absolutely. Cutting into the bone is just as dangerous as ignoring the fat.

This is why tracking your key performance indicators (KPIs) is non-negotiable. If you slash your marketing budget and your client acquisition cost (CAC) skyrockets, you didn't save money—you just shot your firm's growth prospects in the foot.

The rule is simple: never cut anything that directly generates revenue or strengthens your core legal services. Everything else is fair game. Learning how to reduce operational costs is a balancing act, a constant cycle of trimming, measuring, and adjusting until you find what works for your practice.

If you're looking for a direct, high-impact way to reduce payroll costs without sacrificing quality, HireParalegals can connect you with pre-vetted, experienced legal support staff in as little as 24 hours. Discover how to cut your hiring costs by up to 80%.