20 minutes read

20 minutes read

Yes, online jobs are legal. But hiring remote staff—especially across borders—feels like navigating a legal minefield blindfolded. This isn't about finding someone on Upwork and crossing your fingers; it's about building a modern law firm without making a mistake that craters your career.

Turns out there’s more than one way to hire elite legal talent without paying a downtown rent premium.

You've seen other firms tapping into a global talent pool, and that little voice in your head won't shut up: "Why not me?" The dream of a superstar paralegal who doesn't need a corner office—or the New York salary that comes with it—is hard to ignore.

Then your lawyer-brain kicks in, flashing red alerts. Is this even allowed? How do I manage compliance? What about malpractice risk? These aren't just paranoid questions; they’re the only questions that matter.

The truth is, hiring remote legal talent can be a game-changer. But it’s not the Wild West. Without a rock-solid plan, you’re just gambling with your license.

Let's cut the fluff and lay out the major hurdles. This table summarizes the landmines that can trip up even the sharpest firms.

| Legal Risk Area | What It Really Means for Your Firm | The Only Thing That Matters |

|---|---|---|

| Unauthorized Practice of Law (UPL) | Your well-intentioned remote paralegal accidentally gives legal advice or does work reserved for licensed attorneys. | Lock down the paralegal’s role. They perform non-lawyer tasks under your direct, hawk-like supervision. Period. |

| Employment Misclassification | That classic "contractor vs. employee" headache gets a thousand times worse across state or national lines. The IRS and DOL love these cases. | Classify workers based on labor laws in their location, not yours. Get this wrong and prepare for back taxes, fines, and benefit obligations. |

| Data Privacy & Security | Client data is being accessed from a home network thousands of miles away. A breach isn't a tech problem; it's an ethics violation waiting to happen. | Implement and enforce Fort Knox-level security protocols: mandatory VPNs, access controls, data encryption. No excuses. |

| Cross-Border Payroll & Tax | You can't just Venmo a team member in Colombia and call it payroll. Each country has a rulebook thicker than your Torts textbook. | Set up a payroll system that plays by the local rules of your remote team. Ignore this, and you’ll meet foreign tax authorities the hard way. |

These aren't theoretical problems from a law school exam. They are real-world, firm-sinking risks.

The remote work revolution has bulldozed the old way of doing business, and the legal field isn't getting a pass.

As of early 2025, around 28% of the global workforce was at least partially remote. This has forced a reckoning with old-school legal frameworks, creating new headaches—and massive opportunities. You can explore more remote work trends to see just how big this shift really is.

This guide is your map through that minefield. Forget the generic advice. We're going to give you a pragmatic, step-by-step plan to hire legally, safely, and effectively. Think of this as the brutally honest conversation you need before you post that first job ad. Let's get into it.

Alright, let's tackle the monster under the bed. The one that keeps managing partners up at night: Unauthorized Practice of Law (UPL). It's the biggest fear that stops most law firms from even thinking about tapping the global talent pool.

Imagine you find an amazing remote paralegal in another state—or country. They’re sharp, efficient, and their rate doesn't make your eyes water. But what happens when their work drifts from "paralegal tasks" into "giving legal advice"?

That, my friend, is the essence of UPL. And state bars do not have a sense of humor about it. Getting this wrong isn't a slap on the wrist; it’s a direct threat to your license to practice.

So, where's the line? It’s often fuzzier than we’d like, but it boils down to one simple principle: a non-lawyer cannot perform tasks that require a lawyer's professional judgment.

The real challenge? "Professional judgment" feels subjective, especially when your team is scattered across time zones. It's shockingly easy for lines to blur when all your communication happens through a screen.

Here’s a practical breakdown of what flies and what absolutely does not.

Safe Territory (Delegable Tasks):

Danger Zone (UPL Territory):

The difference is stark. It’s formatting a motion versus writing the core argument. It’s gathering facts from a client versus advising them on their next move. One is support; the other is practicing law.

If you take one thing from this section, make it this: supervision is everything. You, the licensed attorney, are responsible for every single piece of work that leaves your firm. That responsibility doesn't change just because your paralegal is in another zip code.

And "supervision" isn't passive. It's not assigning a task and hoping for the best.

It's an active, documented process. Regular check-ins, clear communication channels (think Slack or Microsoft Teams), and a non-negotiable policy that you review and approve all substantive work before a client or court ever sees it.

Build a system where your remote paralegal can’t go rogue, even accidentally. That's how you slay the UPL boogeyman.

Ah, the siren song of the independent contractor. No payroll taxes, no benefits, no pesky employment laws. You find a great remote paralegal, sign a simple contract, and you're off to the races.

Sounds great, right? Wrong. So, so wrong.

Misclassifying an employee as a contractor is one of the fastest ways to get a friendly—and very expensive—letter from the Department of Labor and the IRS. The penalties are brutal, and "oops, I didn't know" is not a valid legal defense. This isn't just a compliance headache; it's a financial catastrophe waiting to happen.

Forget what you call them in your neatly drafted independent contractor agreement. A contract can say "contractor" in 72-point font, but if the relationship screams "employee," the government will laugh at your paperwork.

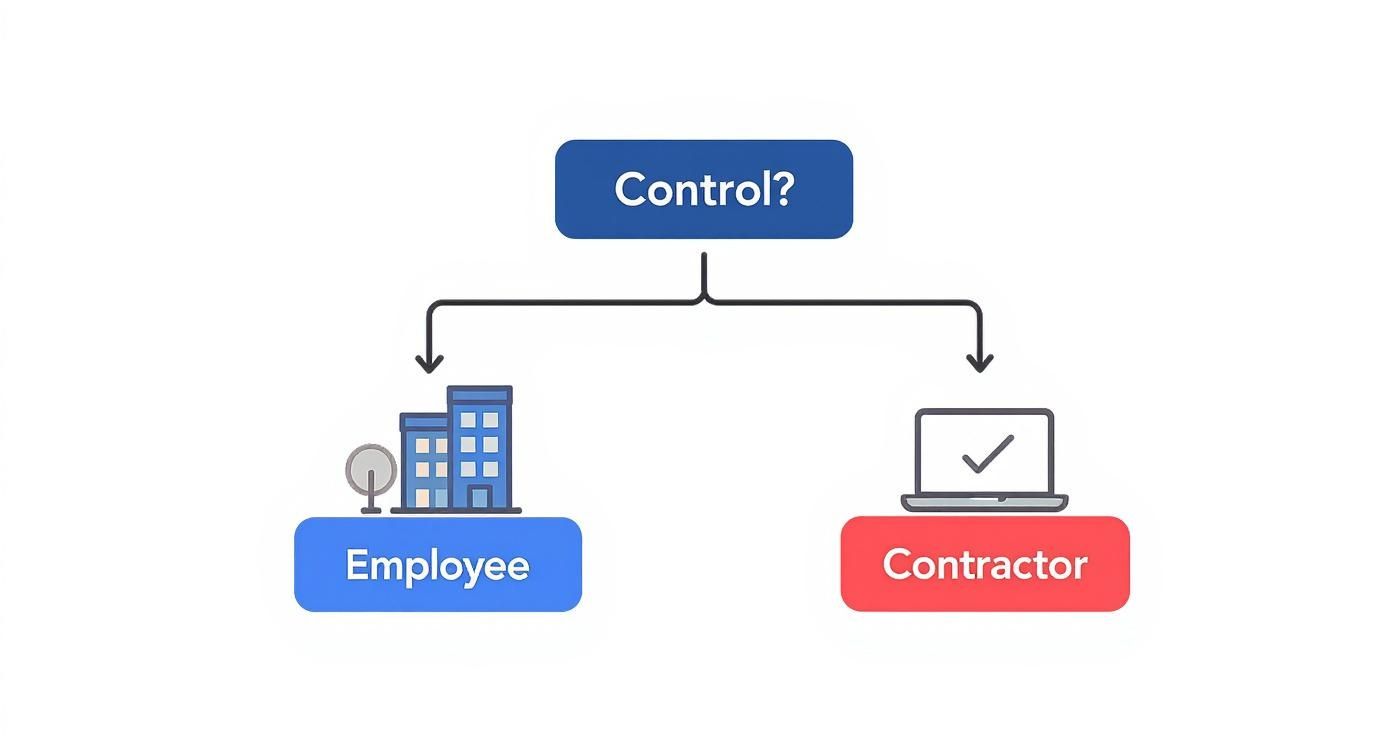

It all boils down to one thing: control. The more control you exert, the more likely you have an employee, regardless of your intentions.

Here’s a quick reality check. Ask yourself these questions about your remote hire:

If you're dictating their schedule, providing their tools, and they're working full-time exclusively for you, you’re not hiring a contractor. You're hiring an employee and trying to stick a different label on it. And the government knows it.

This classification nightmare is why Employer of Record (EOR) services have exploded. An EOR is a professional employer in another state or country. They legally hire the worker on their local payroll, handle all the taxes, benefits, and compliance, and you pay the EOR one simple invoice.

It’s the closest thing to a get-out-of-jail-free card for this exact problem. You get the talent without the direct employment risk. No more late-night Googling of another country’s labor laws.

The gig economy has only made the online jobs legal landscape murkier. Research shows that while many participate in online labor platforms, only about 2% earn enough ($1000+) to trigger formal tax obligations. This has pushed governments to update labor laws, providing clearer contracts and social security for platform workers, further blurring the old lines. You can read more about the evolving legal recognition of online platform work to see how the ground is shifting.

Ultimately, getting this right from day one saves you a world of pain. A bit of due diligence now beats a massive bill from the IRS later. For a deeper dive, check out our guide on what is contingent workforce management. It's a critical skill for any modern firm.

So, you’ve discovered the incredible talent pool in Latin America. Fantastic! The thought of a brilliant paralegal in Colombia for a fraction of a U.S. salary is enough to make any law firm owner giddy.

Let's pump the brakes for a second.

Hiring someone in Bogotá isn't like hiring someone in Boise. Thinking you can just PayPal them every month is a rookie move—and a recipe for a full-blown international headache.

Each country is its own labyrinth of labor laws, payroll requirements, and social contributions. Ever heard of the ‘thirteenth-month salary’? It's a mandatory year-end bonus in many countries. If you don't know about it, you're already in trouble. This is the stuff compliance nightmares are made of.

Taking your firm global means playing by a new set of rules. The two biggest landmines are permanent establishment risk and the sheer complexity of international payroll. Ignore them at your peril.

Permanent Establishment Risk is a fun one. It’s the risk that your remote hire’s activities accidentally create a taxable presence for your firm in their country. If a foreign tax authority decides your paralegal in Brazil is acting like a local branch, congratulations—you might now owe Brazilian corporate taxes.

Then there's payroll. It’s not just converting dollars to pesos. You have to navigate:

This decision tree gives a simplified view of the first critical step: classifying your talent. It only gets trickier across borders.

The flowchart makes it painfully clear: the degree of control you exert is the fundamental test.

Okay, enough with the scary stuff. How do you actually do this legally? You have three main paths. Let's break them down.

I've put together a reality check on the most common ways firms try to hire international talent.

| Hiring Model | The Pitch | The Catch | Best For… |

|---|---|---|---|

| Direct Hire (DIY) | "We want total control!" | Massive administrative burden, high costs, and compliance nightmares. Utterly insane for most firms. | Giant multinational corporations with dedicated international HR and legal departments. |

| Independent Contractor | "It's so simple and cheap!" | Sky-high risk of misclassification, leading to back taxes, fines, and benefit liabilities. | Genuinely short-term, project-based work with a clear end date. And even then, be careful. |

| Employer of Record (EOR) | "Compliance without the headache." | You pay a third-party partner, and it costs more than a contractor (but way less than a lawsuit). | Firms of any size wanting to hire full-time international talent safely and legally. The smart choice. |

As you can see, what looks easiest on the surface often carries the most hidden danger.

Let's dig a little deeper:

1. Direct Hire (The DIY Disaster): This means you set up your own legal entity in the foreign country. Unless you're a massive firm with a budget to burn on foreign legal counsel, this is practically insane.

2. Contractor Model (The Minefield): You hire them as an international contractor. This can work for a short-term project, but for any long-term role? If that "contractor" works for you full-time and you exert significant control, you're just misclassifying them on an international scale.

3. Employer of Record (EOR) (The Sanity Saver): You partner with an EOR service that acts as the legal employer in that country. They handle the local contract, payroll, taxes, and benefits. You manage the day-to-day work. It’s the cleanest, safest way to tap into global talent.

We’ve seen firms try all three. The ones who attempt to DIY or play fast and loose with contractor agreements almost always regret it. The cost of an EOR is a rounding error compared to the cost of getting cross-border compliance wrong.

This isn't just about avoiding legal trouble. It's about being a good employer. Your remote team deserves to be paid compliantly and receive their local benefits. An EOR ensures you can provide that while protecting your firm from a world of hurt.

Let's cut to the chase. The one thing that is absolutely non-negotiable: client confidentiality. Your clients hand you their most sensitive information, and you have an ironclad ethical duty to guard it with your life.

So, how do you square that with a remote paralegal accessing confidential files from their home Wi-Fi, possibly in another country? If that question doesn't send a jolt of anxiety down your spine, it should. It’s a massive risk if you don’t manage it like your license depends on it—because it does.

We’re not just talking about good IT habits. We’re talking about a web of data privacy laws like GDPR or CCPA, secure access protocols, and that malpractice insurance policy you signed. I guarantee it has opinions on the matter.

Hate to break it to you, but you’re now a part-time IT security auditor. Vetting a remote worker’s setup is officially part of your job, and you can't just ask, "Is your Wi-Fi password-protected?" and call it a day.

You have to operate under the assumption that their home network is as secure as a screen door on a submarine. The responsibility falls on you to create a secure bubble for them to work in. This isn't just a good idea; it's the cost of entry.

As of 2025, online and remote work are legally recognized mainstream practices. This shift has pushed data privacy to the forefront, with new laws holding companies accountable for protecting information, no matter where their workforce is. Discover more insights about the state of remote work.

This means your security strategy needs to be a trifecta of technology, policy, and contracts. Get one wrong, and the whole thing crumbles.

Forget the vague advice. Here’s a practical checklist of things you absolutely must have in place before any remote team member sees a single client file. This is the bare minimum for any law firm that's serious about online jobs legal security.

Think of it this way: you wouldn't let a stranger walk into your office and plug a random USB stick into your server. Giving a remote worker access without these protections is the virtual equivalent.

Technology only gets you so far. The human element is where most security plans fail. That’s why your contract is your most powerful security tool.

Your remote worker agreement must include robust clauses that spell out confidentiality, data handling protocols, and the immediate need to report any potential security breach. This isn't boilerplate legalese; it's a binding commitment. For a deeper dive, learn how to handle confidential information in a legal setting.

At the end of the day, your clients' trust is your firm's most valuable asset. Build your hiring practices to protect it.

Alright, we’ve waded through the legal minefields. Enough theory. Let's talk about how to actually do this right—without needing a team of compliance consultants on retainer.

This isn’t generic HR advice from a corporate blog. It’s a practical, step-by-step playbook I've seen work time and again for law firms. This is your roadmap to making your first remote hire a massive win, not a cautionary tale.

Before you even dream of posting a job ad, define the role with a scalpel. Vague job descriptions are a breeding ground for UPL disasters. You need a list of duties so clear there’s zero room for misinterpretation.

This isn't just about side-stepping UPL; it's about setting crystal-clear expectations. A well-defined role ensures you hire someone who is a master at the exact tasks you need done.

Time to put on your interviewer hat. But you can't just recycle those standard, "Tell me about a time you worked on a team" questions. You have to screen for remote work competency and a security-first mindset.

Here are a few questions I always use:

Your remote worker agreement is your single most important line of defense. Please, do not just download a generic template. It needs to be tailored to the realities of remote legal work.

Your contract must include clauses covering:

Your contract isn't just a legal formality; it's the foundation of the relationship. It sets the rules and protects your firm, your clients, and your license.

Finally, the work doesn't stop once the contract is signed. A structured onboarding process is crucial. For a detailed guide, learn how to onboard remote employees to set them up for success from day one.

We’ve navigated some dense territory. It’s enough to make you want to scrap the whole idea and just hire locally. But before you do, let's tackle the questions I hear from managing partners all the time. These are the real-world concerns, answered without the fluff.

The short answer: probably not, and you absolutely cannot assume it does. This is a classic "read the fine print" moment. Most professional liability policies have specific exclusions for work performed by non-employees or services rendered outside the United States.

Don't cross your fingers and hope for the best. Call your insurance provider, lay out your plan, and get their answer in writing. If you don't disclose this upfront, you're handing them a golden ticket to deny coverage when a claim lands. They might require a special rider or proof of specific supervision protocols. Find out before you hire.

Yes, you should worry about it. Permanent Establishment (PE) risk is the danger that a foreign government decides your remote worker's activities have effectively created a taxable presence for your firm in their country. Think of it as accidentally setting up a micro-branch office without knowing it.

This risk becomes very real if your remote paralegal has the authority to sign contracts or is involved in activities that directly generate revenue. If a foreign tax authority determines you have a PE, you could suddenly be on the hook for corporate taxes, penalties, and a world of hurt. This is one of the biggest reasons smart firms use an Employer of Record (EOR). The EOR acts as a legal firewall, shielding your firm from this specific risk.

From a legal and compliance perspective, this is a spectacularly bad idea. I get the appeal—it seems fast and a clever way to dodge bank fees. In practice, it’s a compliance nightmare wrapped in a regulatory train wreck.

Paying someone in a volatile asset like Bitcoin complicates everything. How do you handle tax withholding and reporting? How do you comply with local labor laws, which almost universally require payment in the official currency? It also raises massive red flags for anti-money laundering (AML) regulations.

The bottom line: stick to compliant, traditional payment rails. The perceived convenience of crypto is not worth the immense legal and financial risk. Your job is to practice law, not to become a test case for unregulated international payment systems.