21 minutes read

21 minutes read

Yes, online jobs are perfectly legal. But for a law firm, that’s just the appetizer. The main course is whether you're hiring them lawfully. It’s shockingly easy to get this wrong, and the consequences range from eye-watering fines to ethics violations that can threaten your license.

Let’s be clear: hiring remote legal talent isn't just about changing a payroll address. It’s a whole new operational reality, and winging it is a recipe for disaster.

Everyone’s rushing to hire remote talent right now. And why not? Turns out there’s more than one way to hire elite paralegals without mortgaging your office ping-pong table. Access top-tier talent from anywhere, slash overhead, and grow your practice faster than you ever thought possible.

But here’s the brutal truth many firms learn the hard way: you can't just treat a remote team member like someone in the next office. This goes way beyond getting comfortable with Zoom. It's about navigating a legal minefield where one misstep can have explosive consequences.

So you found a star paralegal three states away. You're ecstatic. But did you stop to think that every time they draft a motion, they could be committing the Unauthorized Practice of Law (UPL) in their home state? Suddenly, your brilliant hire is a massive liability, and your firm is on the hook.

The global workforce sprinted to remote, but the legal frameworks are still lacing up their shoes. By 2025, a staggering 48% of the global workforce will be remote, a huge jump from just 20% in 2020. In the U.S. alone, that's over 32.6 million people working from home, all tangled in a complex web of state and federal rules. You can explore more data on this incredible shift to see what's coming.

This isn't a trend; it's a total rewrite of the employer-employee contract. 'Winging it' isn't just a bad strategy—it's a dangerous one that courts and bar associations are finally taking seriously.

This guide will break down the acronyms that should be keeping you up at night—UPL, employee misclassification, cross-border compliance—and tell you what they actually mean for your firm's bank account and its ethical standing.

Let’s get crystal clear on what can actually go wrong. We've seen these issues derail growing practices time and again.

Here's the highlight reel of what you’re up against:

This table is your cheat sheet for the core legal hazards. Memorize it before you make another remote hire.

| Legal Risk Area | What It Means In Practice | The 'What Could Go Wrong?' Scenario |

|---|---|---|

| Unauthorized Practice of Law (UPL) | A non-attorney or an attorney not licensed in a specific jurisdiction performs tasks that constitute practicing law there. | Your firm faces sanctions, the employee could face legal action, and case outcomes could be jeopardized. |

| Employee Misclassification | Classifying a worker as an independent contractor when they legally qualify as an employee to avoid payroll taxes and benefits. | An audit results in massive fines, back taxes, and potential lawsuits from the worker for unpaid benefits and overtime. |

| Cross-Border Compliance | Failing to adhere to the labor laws, tax regulations, and payroll requirements of the state or country where your remote employee lives. | Fines from foreign tax authorities, legal disputes over employment rights, and major administrative headaches. |

| Data Privacy & Security | Inadequate protection of confidential client information on remote networks, personal devices, or insecure communication channels. | A data breach leads to a malpractice lawsuit, loss of client trust, and disciplinary action from the bar. |

| Malpractice & Vicarious Liability | Your firm is held responsible for the negligent acts or ethical breaches committed by your remote staff, even if they are overseas. | Your firm’s insurance premiums skyrocket after a claim, and your reputation is damaged due to a remote worker's error. |

These aren't hypotheticals. We’ve been in these trenches. This is why a casual, "figure it out as we go" approach to remote legal hiring is officially dead. Let’s dig in.

Alright, let's get straight to it. The single biggest—and most misunderstood—risk you'll face is the Unauthorized Practice of Law, or UPL. It’s the silent threat that can unravel your remote team, spark ethics investigations, and put client matters in jeopardy.

Imagine you find a rockstar paralegal in another state. They're sharp, experienced, and a bargain. You feel like you've won the lottery. But they could be committing UPL every time they draft a document—and when the music stops, you're the one left holding the bag.

Hiring an out-of-state paralegal without mastering UPL rules is like letting an unlicensed electrician rewire your house. Sure, you'll save a few bucks upfront. But when a fire breaks out, the inspector isn't going after the electrician; they're coming after you.

So, what exactly is the "practice of law"? This is where it gets messy. There's no single, tidy definition. It’s a frustrating patchwork of state statutes and bar opinions. Each state fiercely guards its authority to decide what counts.

Generally, UPL involves activities requiring legal skill and independent judgment. For a licensed attorney, that’s just another Tuesday. For a paralegal a thousand miles away, the lines blur dangerously fast.

Here are the common tasks that get well-meaning firms into trouble:

The fundamental issue is that routine tasks a paralegal handles in the office with casual oversight can become UPL landmines when they're done remotely across state lines. The immediate, almost osmotic, supervision of a physical office is gone, creating a real compliance gap.

"But they're supervised! I review everything!" I hear this constantly. It's the default defense for firms dipping their toes into remote hiring, but honestly, it’s a dangerously flimsy shield.

Supervision by a licensed attorney is essential, but it's not a magic wand. Regulators dig into the nature and adequacy of that supervision. Simply rubber-stamping a remote paralegal's work won't cut it. You have to prove you were actively and deeply involved.

The burden of proof is on you, the supervising attorney, to show your remote paralegal was a true extension of you, not an independent legal actor. If you can't, the UPL violation falls on both of you.

This means you need a rock-solid, documented system. A clear trail showing you aren't just delegating tasks but are actively directing, reviewing, and approving any work that even sniffs the UPL line. Building this UPL-proof workflow isn't just a good idea; it's the only way to safely access the benefits of online legal jobs without putting your license on the line.

Let's talk about the big temptation: hiring your remote paralegal as a 1099 independent contractor. So easy. No payroll taxes, no benefits, no complicated W-2s. You think you've found the magic shortcut to scaling your firm.

Spoiler alert: it’s a trap. That shortcut often leads straight off a compliance cliff. The IRS and state labor departments are watching this like hawks. We're talking back taxes, interest, and penalties that can be absolutely crippling.

Think of it as the most boring, high-stakes gamble you can make with your firm’s future.

The heart of the matter isn't what you call them; it's the reality of the relationship. Government agencies use several tests to figure this out, but they all boil down to one question: who has the control?

If you're dictating their hours, forcing them to use your software, and micromanaging their workflow like an in-office employee, you don't have a contractor. You have an employee you’re misclassifying.

Here’s what will get you into hot water:

The rise of the gig economy hasn't made this any clearer. In fact, research shows that while about 8.6% of workers worldwide have done online platform-based work, legal frameworks are struggling to keep up. This creates a messy gray area where firms think they can just slap on a label. You can read the full research on the global online workforce to see how big this issue has become.

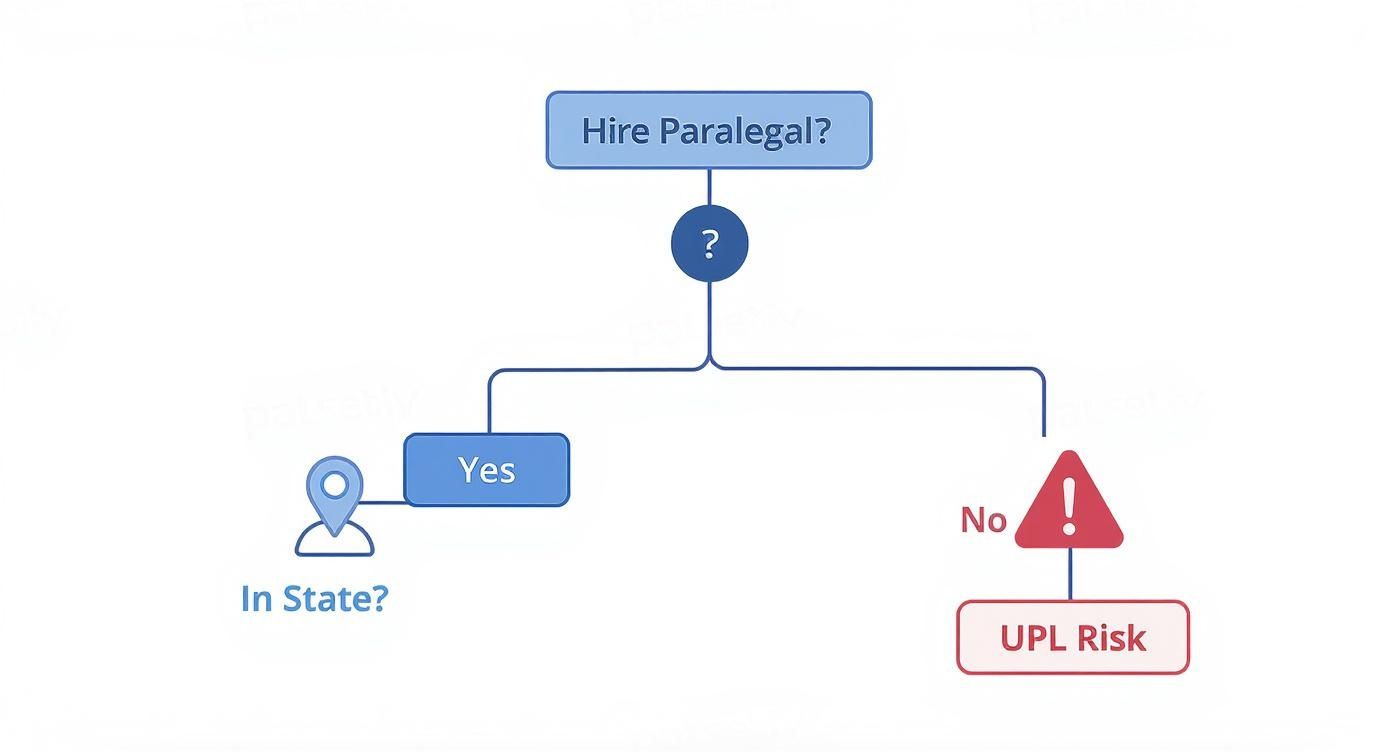

This decision tree shows how quickly the hiring process can get complicated.

As you can see, the very first decision—hiring someone out-of-state—immediately brings major legal hurdles you can't ignore.

So, what's the real damage if you get it wrong? I hope you’re ready to fund a back-dated benefits package. A misclassification finding can force you to pay:

Suddenly, that "affordable" contractor becomes the most expensive hire you've ever made. The short-term savings are completely dwarfed by the long-term exposure. This whole mess is a core part of managing a distributed team, which is why a solid understanding of what contingent workforce management is can save you from these costly blunders.

The bottom line is this: if you want the control of an employee, you need to hire them as an employee. Trying to have it both ways is a losing game that regulators are getting better and better at winning.

Don't let a simple classification error derail your firm's growth. Making the right call from day one is about building a stable foundation for your remote team.

If you thought navigating UPL between California and Texas was a headache, welcome to the big leagues. Hiring someone from another country opens up an entirely different universe of compliance. That amazing paralegal you found in the Philippines? They come with a set of rules that can make interstate hiring look like child's play.

This isn't just about figuring out how to wire money. You have to dive into unfamiliar labor laws, tax treaties, and a tricky little concept called permanent establishment risk—the danger that your one hire could accidentally create a taxable presence for your firm in another country.

Suddenly, you’re not just a law firm owner; you’re an amateur international employment lawyer. And that’s a job nobody wants.

So, how do you tap into a global talent pool without needing a team of international tax advisors on retainer? For most firms, the answer is an Employer of Record (EOR).

Frankly, trying to manage global payroll on your own is a fool's errand. An EOR is a third-party company that legally hires your chosen candidate on your behalf in their home country.

Think of it this way:

This isn't just a convenience; it's a critical compliance shield. It allows you to access a global workforce without becoming a multinational employer overnight. This model has become a cornerstone of legal process outsourcing, enabling firms to scale efficiently and legally.

Let's talk about GDPR. Even if your firm is in Omaha, hiring someone in Europe means you're suddenly playing by EU data privacy rules. The General Data Protection Regulation (GDPR) is notoriously strict, with potential fines that can run into the millions.

And it's not just Europe. Countries from Brazil (LGPD) to Canada (PIPEDA) have their own robust data protection laws. Sending sensitive client information across borders to a remote team member without proper safeguards isn't just bad practice—it's illegal.

You are responsible for ensuring client data handled by your international hire is protected according to their local laws and your ethical obligations. Ignoring this is a malpractice suit wrapped in an international incident.

This means you need airtight data processing agreements, secure communication channels, and clear protocols. Your standard employee handbook isn't going to cut it when your data is crossing oceans.

Going international with online jobs legal requires a pragmatic approach. Here’s the no-nonsense checklist we use to keep things above board:

Tapping into global talent can be a game-changer. But doing it right means respecting that borders are more than lines on a map—they’re complex legal boundaries you cross at your own peril.

Here's a thought that should keep you up at night: your firm's duty to protect client data doesn't stop at the office firewall. With a remote team, that firewall is practically irrelevant. Your firm’s sensitive data is now flowing through dozens of home Wi-Fi networks, and your attack surface has exploded.

This isn't an abstract IT problem anymore. It's a direct threat to your firm’s reputation, your ethical duties, and your malpractice coverage.

Let's be blunt. Is your new remote paralegal using their personal laptop to access client files? The same one their kid uses for gaming and downloading who-knows-what? If the answer is "I'm not sure," you have a serious problem.

Hope is not a security strategy. Asking your remote team to "be careful" online is like leaving your office unlocked overnight and hoping no one wanders in. You have to set a non-negotiable security standard for anyone who touches your firm's data.

It's no longer enough to secure your office. You have to secure the work itself, wherever it happens. In a remote world, every home office is a potential data breach waiting to happen.

This means providing—and mandating the use of—firm-issued equipment. A personal device is a black box of risks you simply can't control.

Protecting your firm doesn’t require a computer science degree, but it does demand discipline. Here’s a rundown of the foundational security measures you need to implement yesterday.

This table breaks down the essentials for keeping your remote operations secure.

| Security Measure | Why It's Non-Negotiable | Implementation First Step |

|---|---|---|

| Mandatory VPN Use | A Virtual Private Network (VPN) creates an encrypted tunnel for all internet traffic, shielding it from prying eyes on unsecured home or public Wi-Fi. It’s like a private, armored convoy for your data. | Subscribe to a business-grade VPN service (like NordLayer or Perimeter 81) and install it on all firm-managed devices, making its use mandatory for accessing any firm resources. |

| Two-Factor Authentication (2FA) | If a password is the lock on your door, 2FA is the deadbolt. It requires a second verification step (like a code from a phone app), making stolen passwords virtually useless to hackers. | Enable 2FA across all critical platforms immediately: email (Google Workspace, Microsoft 365), practice management software, and any document storage systems. |

| Secure File-Sharing Protocols | Emailing sensitive attachments is a disaster waiting to happen. A secure, cloud-based document system provides an encrypted, access-controlled environment. You can control exactly who sees what, and when. | Adopt a secure client portal or document management system (like Clio or MyCase) and train your team on how to handle confidential information properly. |

| Firm-Managed Devices Only | This is the big one. Providing a company laptop gives you administrative control to install security software, block risky applications, and enforce updates, preventing the device from becoming a security risk. | Purchase and configure dedicated laptops for all remote team members with pre-installed security software. Create a clear policy prohibiting the use of personal devices for firm work. |

Think of this checklist as the bare minimum for responsible remote operations.

One final gut-check: have you actually read your malpractice insurance policy lately? Many policies were written for a world of physical offices and contain shocking exclusions related to data breaches originating from remote workers.

Call your provider. Ask them a direct question: "Am I covered if a remote paralegal's personal laptop gets hacked, leading to a client data leak?" The answer might be a very unpleasant surprise.

Ensuring your policy reflects the reality of a distributed workforce is just as critical as having a VPN. Managing the risks of online jobs legal means building a fortress of both technology and policy.

Let's get down to the single most important document you'll create. Your standard employment contract? It’s not built for this. Using a generic template for a remote legal professional is like using a residential lease for a commercial property—it doesn't cover the right risks.

A purpose-built remote work agreement is your operational playbook. It's your first and best line of defense. Get this document right, and you'll sidestep 90% of potential headaches. We’ve seen firsthand what happens when these agreements are vague, and it's a mess you don't want to clean up.

A strong remote agreement does more than just list duties. It's the foundational document that defines the entire professional relationship. It needs to be specific, direct, and leave zero room for interpretation.

The legal framework for remote work is shifting quickly. In Europe, online job markets are standardizing contract terms, heavily influenced by regulations like GDPR. While the U.S. is a patchwork of state laws, the trend is toward formalizing the remote relationship. You can find more data on evolving remote work trends to see how much the landscape has matured.

So, what needs to go into this critical document?

Your agreement is the place to explicitly address the unique challenges of a distributed legal team. Ambiguity is your enemy; precision is your ally.

Think of it as the constitution for your remote workforce—it sets the laws everyone has to follow.

Forget the boilerplate. Your remote work agreement needs clauses that directly tackle the specific risks of online legal work.

Here are the absolute must-haves:

This document is your operational rulebook. It ensures everyone is playing by the same rules, protecting your firm, your clients, and your remote team member. Don't skip this step.

Alright, let's get down to brass tacks. We’ve unpacked the big legal theories. Now, it’s time to tackle the direct, practical questions about online jobs legal issues that probably keep you up at night.

Short answer: yes. Long answer: very, very carefully. This setup only works if you are absolutely militant about preventing the Unauthorized Practice of Law (UPL).

Their work must be strictly limited to tasks that a licensed attorney in your jurisdiction directly supervises and takes full responsibility for. Think of them as an extension of your own hands, not an independent legal mind. Every task must be clearly defined and reviewed.

It's a tightrope walk, and frankly, it's where many well-intentioned firms stumble.

On paper, for the first month? Maybe. You sidestep payroll taxes and benefits, which looks great on a P&L statement. But this is one of the riskiest bets a law firm can make.

The IRS and Department of Labor tests for classifying workers are notoriously strict. If you get it wrong and that contractor is deemed an employee, the fallout is brutal: years of back taxes, steep penalties, and retroactive benefits payments. The potential long-term catastrophe completely wipes out any short-term savings. The only sound strategy is to classify correctly from day one.

The Single Biggest Mistake Firms Make When Hiring Remotely:

The most dangerous assumption is thinking a remote employee is just an in-office employee in a different location. This mindset causes firms to gloss over jurisdictional labor laws, UPL boundaries, and data security on home networks. You have to approach remote hiring as a distinct legal and operational challenge with its own set of rules.